2024 Tax Rates Schedule X - Single

What coverage is essential for my auto policy?

You will need to have liability coverage, property damage, and bodily injury. This way you will be protected if you are at fault and cause damage to a person or their property. It is recommended to have $300,000 per accident to pay medical costs and other costs that may be affiliated. You should also have at least $50,000 in property damage. You should have uninsured motorist coverage, which will protect you against financial damages caused by an uninsured motorist or a hit and run, should one occur.

How do I file an auto insurance claim?

A few tips to ensure that you claim correctly and receive your money as quickly as possible: File the claim immediately; take note of hospital bills, police accident reports, and copies of claims that have been submitted. Take notes of exactly what was said every time you speak with a company representative, make a note of the date and keep the information together in a file. If you get the feeling that the company isn't being forthcoming with the results that you need, complain to the state insurance regulator. If you still feel that your claim isn't getting the attention it deserves, call a lawyer.

2024 Tax Rates Schedule Married Filing Jointly

2024 Tax Rates Schedule Married Filing Seperate

2024 Tax Rates Schedule Head of Household

2024 Tax Rates Schedule Estate and Trusts

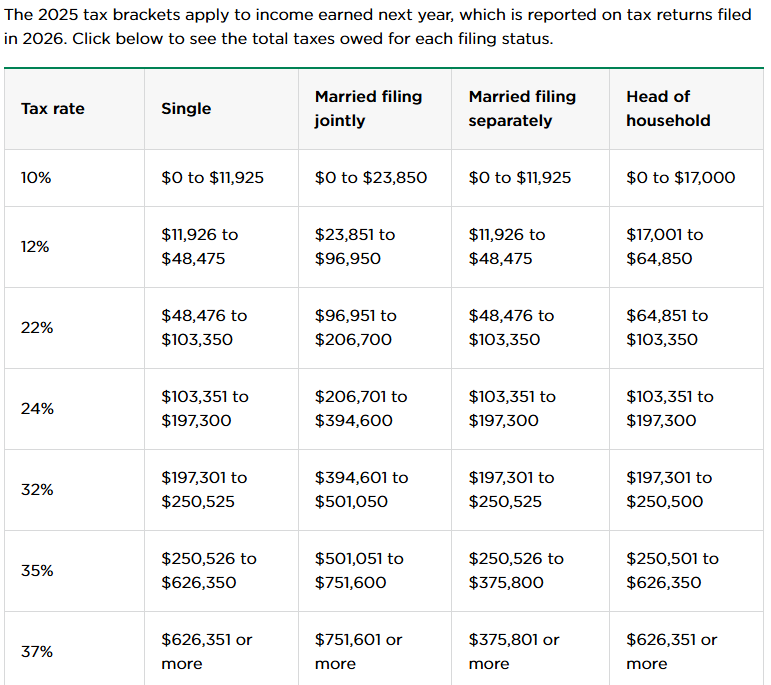

Looking Ahead to 2025